What is Cyber Insurance?

Cyber insurance, also known as cyber liability or cyber crime insurance, is a financial tool that can shield businesses from the financial losses brought on by cyber attacks and data breaches.

As the frequency and severity of cyber attacks keep increasing, it is a crucial instrument for organizations to manage the risks and expenses connected with cyber disasters.

What does it cover?

Cyber insurance can cover a wide range of losses due to cyber attacks. Here are some of the most common types of coverage:

Data Breaches

Data breaches occur when sensitive or confidential information is accessed, stolen, or exposed. Cyber insurance can cover expenses related to data recovery, notification, credit monitoring, and legal fees.

Business Interruption

Business interruption coverage can provide compensation for lost income and expenses related to a cyber attack that disrupts business operations.

Ransomware Attacks

Ransomware attacks occur when a hacker encrypts a business’s data and demands a ransom payment in exchange for the decryption key. Cyber insurance can cover expenses related to ransom payments, data recovery, and legal fees.

Social Engineering Scams

Social engineering scams occur when a hacker uses deception to trick an employee into giving away sensitive information or performing an action that benefits the hacker. Cyber insurance can cover expenses related to losses resulting from these scams, including fraudulent wire transfers and other financial losses.

Network Security Liability

Network security liability coverage can protect a business from liability claims if a cyber attack results in damage to a third party’s systems or data due to a breach of the business’s network security.

Cyber Extortion

Cyber extortion coverage can provide compensation for losses resulting from threats to damage, destroy, or disclose a business’s data unless a ransom is paid.

Brand Damage and Reputation

Brand damage and reputation coverage can provide compensation for losses resulting from damage to a business’s reputation or brand image due to a cyber attack.

Legal Costs and Regulatory Fines

Cyber insurance can cover legal fees and regulatory fines related to a cyber attack, such as those resulting from a violation of data protection laws like GDPR or HIPAA.

What is Not Covered by Cyber Insurance?

It’s essential to understand that cyber insurance does not cover all losses related to cyber attacks. Some common exclusions include losses resulting from cyber attacks that occur before the policy’s effective date, losses resulting from employee theft or fraud, and losses resulting from intentional or criminal acts by the policyholder.

Importance of Cyber Insurance

The importance of Cyber Insurance arises from today’s realities:

- many small and medium businesses but fewer than 5% are prepared;

- the cost of a data breach or cyber attack is significant, ranging from $5,000 to $40,000 per incident;

- many don’t have an established defense plan or regular employee training

- most are not fully aware of their cyber insurance coverage

- cyber-attacks and ransom demands are increasing

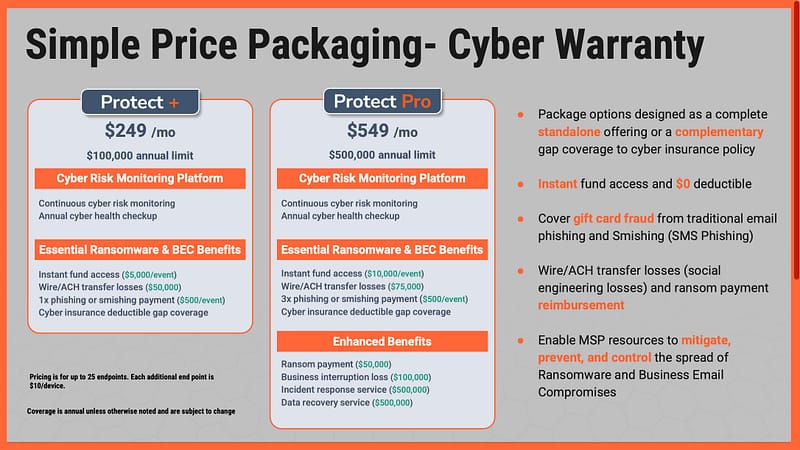

Benefits of a good cyber insurance policy:

- gives better defenses, and remedies;

- improves reputation among customers and partners;

Industry Trends

As the demand for cyber insurance increases, there is a growing divergence in the offerings of insurance companies. While some traditional and established insurance companies are sticking with their traditional policies, others are charging extraordinary premiums for their cyber insurance products. However, cyber insurance is rapidly becoming its own standalone product, breaking off from being a bundled product.

To ensure that they are not taking on too much risk, insurers are demanding more controls to be in place before accepting an application. They are looking at all the controls that are in place to protect against cyber threats, including firewalls, antivirus software, and encryption protocols.

It’s important to note that just because an application is accepted, it does not mean that a successful claim will be paid out. If there is a claim, insurers are mandated to conduct an investigation, and they will find out the truth of your statements. It’s crucial to be honest when filling out your application and to have all the necessary controls in place to minimize your risk of a cyber attack.

At Troinet, we understand that cyber insurance is a rapidly evolving industry, with new trends and developments emerging all the time. That’s why we closely monitor the market to stay up-to-date with the latest developments and ensure that we can provide our clients with the most effective cyber insurance solutions. We work with a wide range of insurance providers to offer our clients the best coverage options at competitive rates, while also providing guidance and support to help them navigate the complex world of cyber insurance.

Must-Have Cyber Security Controls

Next, what controls you must have in place? During application, many businesses state that they have such controls in place.

But if a claim happens, the insurers will perform a check and if you don’t really have what you say you have, your claim will be denied.

Here are the security controls that you must have in place:

- Cyber Security and Phishing Awareness Training

- MFA (Multi-Factor Authentication)

- Risk assessments

How we can help you as cyber insurance advisor

- advise you on what’s in your policy and if you are completely covered

- make sure that your application is accurate

- that your representations are well supported by proof

- protections are in place when insurers verify

- we recommend an auditing process to ensure that your policies in place are what insurers look for and will lead to a high acceptance rate

- ensure “utmost good faith” in all written statements

- make sure you have the right coverage and policies

- you won’t pay out of pocket when something happens

The application is what people feel, our assessments are what’s real. And that’s why we normally come in and do these assessments to see what’s going on.

How this Video will Help You with Cyber Insurance?

- Gain peace of mind in the face of cyber security attacks by having the assurance that when worst happens, you will have best financial, legal, and technical support to get back and running again – and all for the price of a cup of coffee or two each day.

- Learn more than just the importance of insurance coverage, but what the best offerings are.

- Establish both pre and post-incident support to make you resilient and better able to withstand any attack that comes your way.