The cyber insurance industry is changing quickly.

There has been a divergence in insurance companies. There are more traditional, established insurance companies whose logos can be recognized by anyone instantly and who have been in the insurance industry for a very long time.

They have multiple lines such as commercial or general insurance products. They might have workers’ compensation. They have business auto and other types of liability.

But cyber insurance is really becoming its own product just recently over the past years. It is breaking off from being a bundled product. The key distinction here is to understand that it is becoming its own entity. It’s not ideally bundled into a package anymore.

Types of Companies Offering Cyber Insurance

Here are two types of companies offering cyber insurance:

Company Group 1: Traditional companies

Cyber insurance may be offered by more traditional insurance companies who are more comfortable with their actuarial sciences around workers’ compensation and professional liability, but many of them don’t just have enough experience to understand the data on cyber insurance and cyber attacks. And when there is an incident in the cyber world, it can hit the policy limit in just a few days instead of a few years.

These companies who are comfortable with their other traditional product lines are either (a) making it more difficult to get cyber insurance or (b) increasing the cost of cyber insurance and they are sort of ok with their customers saying “we don’t want that certain type of product.”

Group 2: Cyber-specific insurance companies

Cyber insurance is also being offered now by very data-forward cyber-specific insurance companies.

They are really trying to get ahead of the curve and are specializing in this product because they know that cyber insurance over the next 20-50 years will most likely be the largest type of insurance in the marketplace with the evolution of where things are going.

We are also seeing the trend that cyber defenses are seen as becoming more essential. We have to stay ahead of cyber criminals and that’s a challenge. But we are putting ourselves in a great position for cyber insurance if we have these defenses. It’s heavily weighed by insurance companies the types of defenses that are in place when we look at pricing a policy or just the type of policy that’s being covered.

“cyber insurance over the next 20-50 years will most likely be the largest type of insurance in the marketplace”

Getting cyber insurance is becoming increasingly challenging and expensive.

People are getting shocked by the increasing premiums.

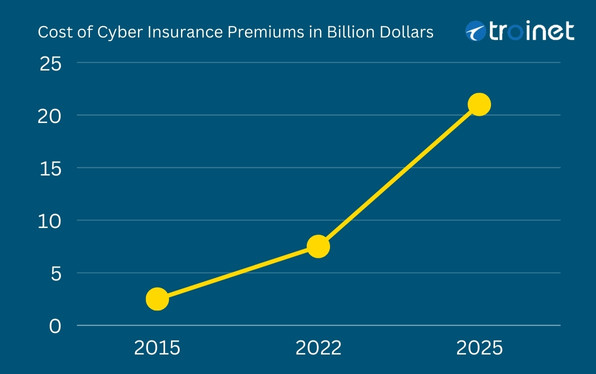

When we look at the cyber insurance market, here is the data we got the chance to get – the cost of the premiums is just going up. We’re seeing the hockey stick effect. We’re seeing some companies double or triple the premium they have to pay. And over the course of 10 years, this hockey stick is starting to go even more vertical and this is something you don’t want to see especially when it is a cost.

So we’re seeing that there’s a dramatic increase in the amount of premiums and the primary driver is the number of ransomware attacks.

Increasing intensity and sophistication of ransomware attacks

See ransomware attacks.